Original post here but its gone :(

https://greatawakening.win/p/16aTVJz8tT

You have heard about the banks and the US monetary system collapsing but have you thought about how it will happen?

Currently the world banking and financial industry is going through the biggest and most vulnerable change ever in it’s history. They are currently changing their Interest Rate Benchmark system which has consequences for ALL underlying contracts. That means mortgages, credit card debt, student loans, derivatives, CDO/CLOs, the valuation of a corporation or bank, this affects EVERYTHING in the financial world! HUNDREDS OF TRILLIONS OF $ WORTH!

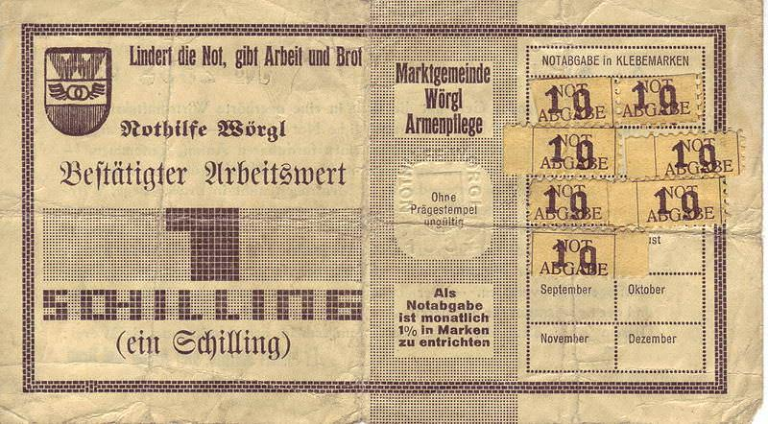

The previous interest rate benchmark system we had before was called LIBOR which stands for London InterBank Offer Rate. LIBOR

came into widespread use in the 1970s

LIBOR is an interest rate average calculated from estimates submitted by the leading banks in London. Each bank estimates what it would be charged were it to borrow from other banks.

https://en.wikipedia.org/wiki/Libor

So basically the banks decide what the interest rates are, not free market.

LIBOR gets its name from The City of London.

https://en.wikipedia.org/wiki/City_of_London

LIBOR is watched closely by both professionals and private individuals because the LIBOR interest rate is used as a base rate (benchmark) by banks and other financial institutions. Rises and falls in the LIBOR interest rates can therefore have consequences for the interest rates on all sorts of banking products such as savings accounts, mortgages and loans.

https://www.global-rates.com/en/interest-rates/libor/libor.aspx

It was found after a 2012 investigation that the banks were fraudulently getting together and manipulating the interest rates for their own profit back to 2003, known as the LIBOR Scandal.

https://en.wikipedia.org/wiki/Libor_scandal

On 27 July 2012, the Financial Times published an article by a former trader which stated that Libor manipulation had been common since at least 1991.

https://www.informath.org/media/a72/b3.htm

This manipulation was in large part an underlying reason for the 2008 Great Financial Crisis.

So the Bank of London and several other Central Banks around the world decided to change their Interest Rate Benchmark. In the US, our govt decided to change it to SOFR. This is significantly more important than others because so many international transactions around the world involve $USD and therefore our monetary system. In fact according to the Bank of International Settlements, in 2019 78% of international transactions involved $USD.

SOFR stands for Secured Overnight Financing Rate. It’s based on the rates that large financial institutions pay each other for overnight loans.

Libor was based on the rates that financial institutions said they would offer each other for short-term loans. But SOFR takes into account actual lending transactions between institutions, making it more reliable than Libor, which Weller says was subject to insider manipulation.

“One key difference between Libor and SOFR is that Libor was forward-looking while SOFR is backward-looking,” Patel says. “This means that with Libor banks knew what the borrowing rate was at the beginning of the period. But since SOFR is backward-looking, the borrower won’t know exactly what they owe until the end of the loan.”

FORBES - What Is SOFR? How Does It Work? - Forbes Advisor https://archive.ph/cMSXW

In other words, the interest rate changes over time and is not static or stable. Also on all accounts I’ve seen, the interest rate is higher for SOFR than for previous LIBOR contracts. It looks like to my untrained eye that the more contracts that change to SOFR, the higher the SOFR interest rate seems to go.

Now what has been happening in the news lately? Bank liquidity issues are causing these banks to default and bank runs happening because of the panic. What is very likely and significantly contributing to these bank runs is this LIBOR to SOFR transition! Think about it, this interest rate underlies the value of corporations and BANKS! Banks operate based on how much assets they own and how many loans/contracts they are leveraged by. If the underlying value of a bank is changing rapidly (and getting lower over time) this will present liquidity problems for banks that can easily lead to insolvency!

Now the Federal Reserve has decreed that all banking institutions in the US monetary system must replace the LIBOR system with the SOFR system in contracts that are already in place. Yes contracts that were put in place previously will now have to adopt the SOFR system in the middle of the contract being used.

Now the original date for this change was in 2021 but in September to October 2019, a trial run was done with about $70-80 Trillion worth of contracts. This trial run seems to have been a failure because the banks went quiet for a while and then pushed the date back. The Federal Reserve set the cutoff date to be June 30, 2023.

(Jan-11-2021) BLOOMBERG - Libor Proving Hard to Kill in $200 Trillion Derivatives Market https://archive.ph/YOjN4

Federal Reserve Board adopts final rule that implements Adjustable Interest Rate (LIBOR) Act by identifying benchmark rates based on SOFR (Secured Overnight Financing Rate) that will replace LIBOR in certain financial contracts after June 30, 2023 https://www.federalreserve.gov/newsevents/pressreleases/bcreg20221216a.htm https://archive.ph/UwwCD

Hundreds of Trillions of dollars of contracts need to re-evaluated at this different SOFR interest rate by June 30, 2023. There are going to be issues no matter what happens. Now the Federal Reserve and banks may try to cover up these issues in the LIBOR to SOFR transition by blaming the story on something else (hey it’s not hard to do, they are all corrupt!). So certain fall guys (Hey Silicon Valley Bank!) will likely be taking the blow for the spillover.

The area that is most problematic is Collateralized Loan Obligation (CLO) market. In 2008, the freezing of the CDO market (Collateralized Debt Obligation) collapsed the system. What rose up from that are CLOs. CLO traders are not liking this because they're getting less money from the change and so they're actually fighting it. They’re having a hard time dealing with this transfer over to SOFR bu June 30, 2023. Many other contracts like mortgages have legal language that makes it simple for the loan holders to set up whatever they want but ongoing CLOs don’t have the same kind of legal language.

WIKIPEDIA - Collateralized Debt Obligation https://archive.ph/Gmn7r

WIKIPEDIA - Collateralized Loan Obligation https://archive.ph/z6p3h

If something breaks in this transition from LIBOR to SOFR, this can easily crash the world financial system in a way that makes 2008 look like a cake walk. This is how the system will crash. I’ve been hearing there’s an estimated $600-700 Trillion+ that needs to be transitioned over. A screwup of a Trillion could mess up our system, this is the edge of the US Monetary system and it’s walking a fine line over the abyss. What comes next will be an introduction to CBDCs.

Extra Links:

(Dec-2022) The whole interview is worth watching. LIBOR SOFR QE Systemic risk, all make an appearance. They’re starting to talk. $65 Trillion of Derivatives debt sparks concern

https://teddit.net/r/Superstonk/comments/ze0thz/the_whole_interview_is_worth_watching_libor_sofr/

(Feb-15-2023) REDDIT SUPERSTONKS - Libor to SOFR transition - Good Ol Boys club having issues?

Sherman Urges Congress to pass LIBOR Act

https://www.youtube.com/watch?v=GGFF0l6dgPI

(Nov-28-2021) REDDIT SUPERSTONKS - LIBOR, SOFR, ONRRP, AND WHY IT MAY BE A BIGGER CRISIS THAN WE THINK.

JP MORGAN - Goodbye LIBOR, hello SOFR - The transition from LIBOR has led to major changes in the pricing of global financial products. Here’s what businesses need to know.

https://www.jpmorgan.com/commercial-banking/insights/the-global-move-away-from-LIBOR

USD LIBOR transition to SOFR: Making it happen

Council on Foreign Relations - Understanding the Libor Scandal

ROLLINGSTONE - Taibbi: Is LIBOR, Benchmark for Trillions of Dollars in Transactions, a Lie?

(Jan-9-2023) The End of Libor: Are You Prepared for the Coming Storm?

https://www.youtube.com/watch?v=C8fnAHAkWI0

Economist Michael Hudson Says the Fed “Broke the Law” with its Repo Loans to Wall Street Trading Houses

The Transition From LIBOR to SOFR and its Implications for Taxpayers

https://teddit.net/r/Superstonk/comments/utd3n4/the_transition_from_libor_to_sofr_and_its/

Speculation: Tom Luongo, FED/Powell/Dimon, SOFR vs LIBOR, US vs EU, etc.