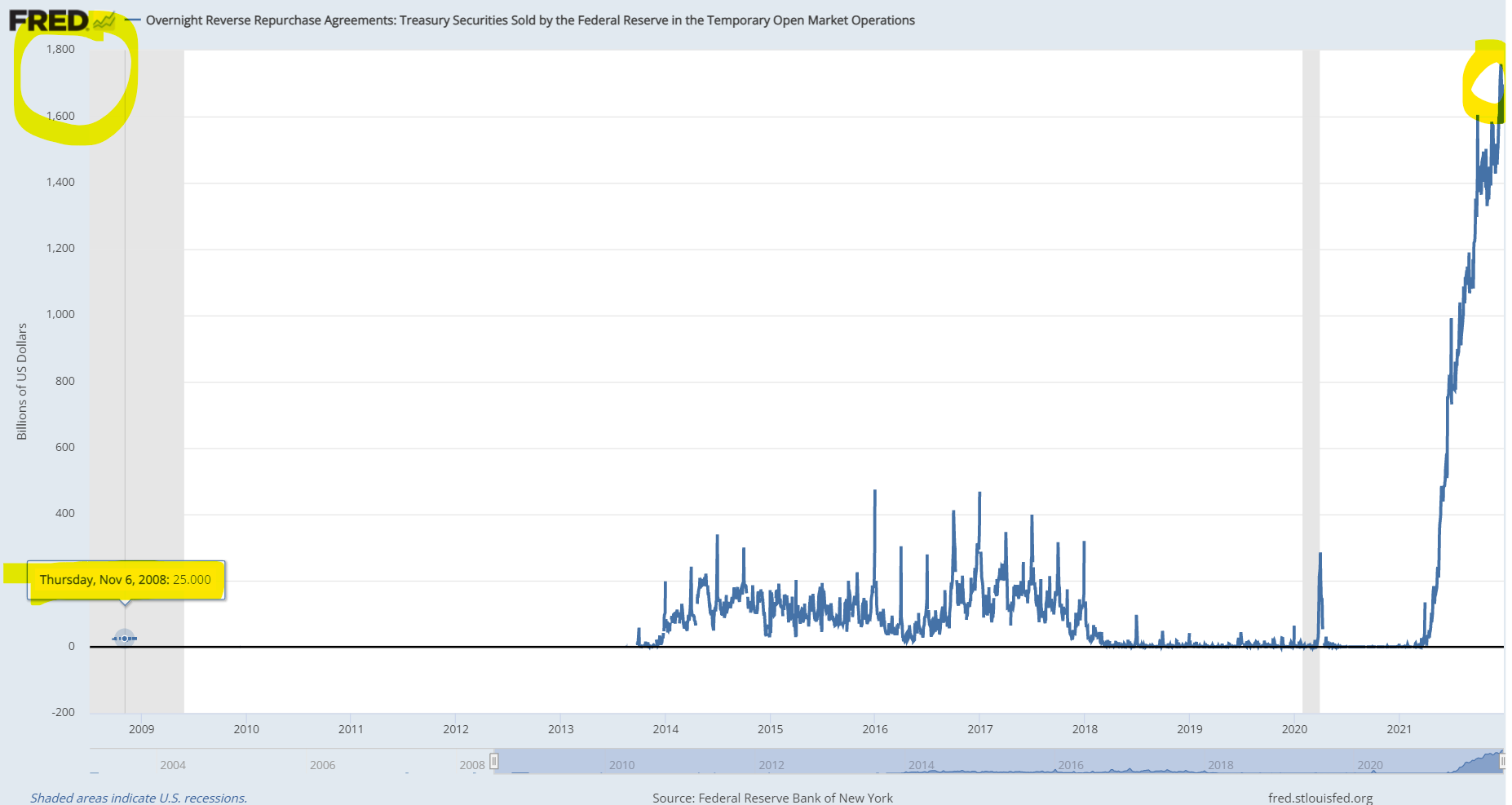

Reverse Repo is staggering (Thanks to Anon who posted the original!) - This looks all the way back to 2008. Which barely shows up on the radar. Back during that last big recession we saw $25 billion reverse repo... now we're seeing $1.7+ TRILLION in reverse repo.

(media.communities.win)

👀 EYES ON! 👀

See if this helps. I pulled it from an article..Only certain banks are directly affected by that interest rate control.

A significant part of our financial system isn’t banks — it’s other things, like hedge funds or money market mutual funds. For them, the Fed needs a different tool to set interest rates. It’s called REVERSE REPO.

It’s not new, but the Fed has been testing it out and they might roll it out again down the line. On a scale of 1 to sexy, Reverse Repo sounds like a negative 10. But really, I promise, “the repo market is actually a very very critical part of money markets,” as Frederic Mishkin can attest. He teaches at Columbia’s Graduate School of Business. Before we talk Reverse Repo, let’s talk regular Repo. Here’s how it works. When a big financial institution wants to say make a loan, but it doesn’t quite have enough cash to do it, it’ll basically…. go to a pawnshop to pawn off it’s bonds. It goes something like this: BANK OF STACEY VANEK SMITH: “Hey RepoPawnShopForBanks…. listen… I need some cash to lend to my friend who wants to build a factory – she’s gonna pay me back with 5 percent interest! So can I pawn these bonds? You gimme some cash for them. But keep the bonds on hand for me, cause I’m gonna want them back later. I’ll buy them back for a little more than you paid and you can make a little money. REPO PAWN SHOP FOR BANKS: “Sounds cool, here’s some cash, hand over the bonds, they’ll be safe with me. I’ll sell them back to you when you have cash again. Good luck with your factory friend.” In reality, the pawn shop is another bank or financial institution, and they do this with one another all the time. One day one money market mutual fund is the pawn shop, another day it’s the one doing the pawning. Incidentally, the fact that the two financial institutions agree that the bonds will get repurchased is why it’s called a repo agreement. The point is: The Repo market is like a pawn shop for financial institutions and it helps them lend. So what’s Reverse Repo? It’s what you do to get financial institutions like the Bank of Stacey NOT to lend so much or so generously. Perhaps you are the Fed four years in the future and you are worried about inflation because people are lending too much. Here’s how you do it: FEDERAL RESERVE: “Hey Bank of Stacey, this is the Federal Reserve Reverse Repo Pawnshop. Listen, I know you wanted to lend to your friend and get 5 percent interest back , but that’s awfully low. I don’t think you should be so generous. In fact, why don’t you just lend that factory money to ME instead of to your friend. I’m not gonna build a factory with it. I’m gonna do NOTHING with it. Here, I’ll pawn my bonds to YOU, and I’m gonna buy them back later for 10 percent more than you gave me – it’ll be like you’re making 10 percent interest!” BANK OF STACEY: “What about my friend?” FEDERAL RESERVE REVERSE REPO PAWN SHOP: “Um can she pay 10 percent interest? I don’t think so. So if you could just go ahead and lend me the money. Kthxbai.” See how that worked? The Bank of Stacey isn’t going to go investing in some shady factory for 5 percent when it can invest in the Fed for 10 percent. In fact, if given the option, the Bank of Stacey would still prefer investing with the Fed at 5 percent too — because there is no risk that the Fed would ever not pay the Bank of Stacey back. The Bank of Stacey might still decide to loan money to the factory, but that factory is gonna have to sweeten the deal. It’ll have to pay more than 10 percent interest. Probably a lot more. So whatever the Fed offers to pay, everyone else in the economy has to pay that or more. Reverse Repo allows the Fed to set a floor on the interest rates in the economy. If it raises that rate, it raises all interest rates in the economy (since they are all based on the zero risk benchmark of the Fed or Treasury). If it drops that rate, all interest rates in the economy drop. The most important difference between Reverse Repo and the Interest On Excess Reserves that we discussed yesterday is that Reverse Repo applies to many more financial institutions than just banks. And that is Reverse Repo. It’s a way of controlling interest rates for not just banks but all kinds of financial institutions.

The personification of the banks and such really helped, you made it quite clear for me. I appreciate that whole heartedly, thank you fren