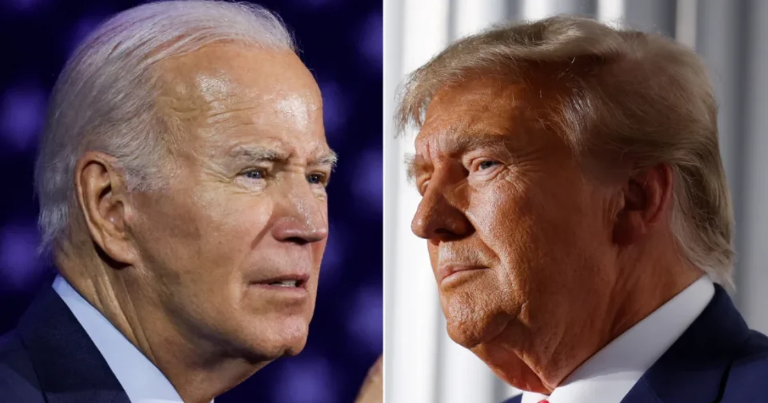

Trump to Immediately Unwind Joe Biden’s Unconstitutional Student Loan Forgiveness Plan

(www.thegatewaypundit.com)

You're viewing a single comment thread. View all comments, or full comment thread.

Comments (58)

sorted by:

I wrote an actual Bill on Policies for People that would take care of the student loan crisis... the issue is getting one of our useless ass lawmakers to put it forward.

A BILL

To amend the Higher Education Act of 1965 to eliminate interest charges on federal student loans and to provide relief for existing borrowers.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,

SECTION 1. SHORT TITLE.

This Act may be cited as the “Student Loan Interest Elimination Act of 2024”.

SECTION 2. FINDINGS.

Congress finds the following:

(1) The total outstanding student loan debt in the United States exceeds $1.7 trillion.

(2) The average student loan borrower graduates with approximately $37,000 in debt.

(3) Interest accumulation on student loans significantly increases the total amount borrowers must repay, often resulting in loan balances that grow larger despite regular payments.

(4) Student loan debt disproportionately affects low-income and minority borrowers, contributing to wealth inequality.

(5) High student loan payments prevent many Americans from purchasing homes, starting businesses, saving for retirement, or participating fully in the economy.

(6) The current system of charging interest on student loans creates a significant barrier to economic mobility and financial stability for millions of Americans.

SECTION 3. ELIMINATION OF INTEREST ON FEDERAL STUDENT LOANS.

(a) IN GENERAL.—Section 455 of the Higher Education Act of 1965 (20 U.S.C. 1087e) is amended by adding at the end the following:

"(r) ELIMINATION OF INTEREST.— "(1) Notwithstanding any other provision of this Act, effective immediately upon enactment, the Secretary shall not charge interest on any loan made under this part. "(2) For loans made prior to the date of enactment of this subsection, any outstanding interest shall be— "(A) immediately frozen upon enactment; "(B) segregated from the principal balance; and "(C) forgiven upon completion of 24 consecutive, on-time monthly payments.

(b) CONFORMING AMENDMENTS.— (1) All references to interest rates in the Higher Education Act of 1965 shall be interpreted as requiring a zero percent interest rate for federal student loans. (2) The Secretary shall update all loan documentation, materials, and systems to reflect the elimination of interest charges.

SECTION 4. BORROWER RELIEF AND IMPLEMENTATION.

(a) BORROWER NOTIFICATION.— (1) Within 30 days of enactment, the Secretary shall notify all current federal student loan borrowers of— (A) the elimination of interest charges on their loans; (B) the segregation of existing interest from principal; and (C) the requirements for interest forgiveness.

(b) SERVICER REQUIREMENTS.— (1) Loan servicers shall— (A) immediately cease charging interest on all federal student loans; (B) update their systems within 60 days to reflect the changes required by this Act; (C) provide updated loan statements showing separate principal and legacy interest amounts; and (D) implement tracking systems for the 24-month interest forgiveness program.

(c) BORROWER PROTECTIONS.— (1) No borrower shall be required to make payments on segregated interest until completing the 24-month program. (2) Any amounts paid toward interest during the implementation period shall be credited to principal. (3) Borrowers in default shall be eligible for interest elimination upon entering a rehabilitation program.

SECTION 5. FUNDING AND OFFSET PROVISIONS.

(a) AUTHORIZATION OF APPROPRIATIONS.— (1) There are authorized to be appropriated such sums as may be necessary to carry out this Act. (2) The Secretary shall submit annual reports to Congress detailing the costs associated with interest elimination.

(b) OFFSET.— (1) The Secretary of the Treasury shall conduct a study identifying potential revenue sources to offset the cost of interest elimination, including but not limited to: (A) Financial transaction taxes (B) Corporate tax reform (C) Wealth taxes (D) Reduced administrative costs from simplified loan servicing

SECTION 6. EFFECTIVE DATE.

This Act shall take effect immediately upon enactment.

SECTION-BY-SECTION ANALYSIS

Benefits and Rationale:

Immediate Financial Relief Eliminates ongoing interest accumulation on all federal student loans Provides a path to forgiveness of existing interest through consistent payment Reduces monthly payment amounts for millions of borrowers Prevents loan balances from growing due to interest capitalization Economic Stimulus Increases disposable income for approximately 45 million borrowers Enables increased consumer spending and investment Facilitates home ownership and business formation Improves retirement savings capacity Stimulates job creation through increased economic activity Social Equity Reduces the disproportionate impact of student debt on low-income borrowers Narrows the racial wealth gap Improves social mobility Makes higher education more accessible and affordable Simplified Loan Servicing Reduces administrative complexity Decreases servicing costs Improves borrower understanding of loan terms Reduces errors and disputes Educational Access Removes financial barriers to higher education Encourages pursuit of public service careers Reduces dropout rates due to financial stress Promotes workforce development Mental Health Benefits Reduces stress and anxiety related to growing debt burdens Improves overall well-being of borrowers Enables better work-life balance Reduces depression and other mental health impacts Family Formation Enables younger Americans to start families earlier Improves ability to save for children’s education Facilitates multi-generational wealth building Supports housing stability for families Market Effects Increases small business formation Improves housing market participation Enables greater workforce mobility Stimulates innovation and entrepreneurship Fiscal Responsibility Reduces default rates Improves loan repayment rates Decreases collection costs Simplifies budget planning for borrowers Long-term Economic Growth Increases human capital investment Improves labor market efficiency Supports innovation and productivity Strengthens middle class growth Implementation Timeline:

Phase 1: Immediate Implementation (0-30 days)

Interest charges cease on all federal student loans Borrower notification process begins Servicer system updates initiated Phase 2: System Updates (31-60 days)

Loan servicer systems fully updated New statement formats implemented Interest segregation completed Phase 3: Interest Forgiveness Program (Months 3-24)

Tracking of consecutive payments begins Interest forgiveness process implemented Progress reporting system established Phase 4: Long-term Monitoring (Ongoing)

Cost assessment and reporting Economic impact studies Program effectiveness evaluation Conclusion:

The Student Loan Interest Elimination Act represents a transformative approach to addressing the student debt crisis while maintaining the principle of loan repayment. By eliminating interest charges while preserving the obligation to repay principal, this legislation strikes a balance between providing necessary relief to borrowers and maintaining fiscal responsibility.

The Act’s implementation is designed to provide immediate relief while establishing a sustainable long-term solution to the student debt crisis. Through careful planning and phased implementation, the legislation ensures that both borrowers and loan servicers can adapt to the new system while maximizing the economic and social benefits of interest elimination.

The combination of immediate interest elimination and a path to legacy interest forgiveness provides both instant relief and an incentive for consistent loan repayment. This approach is expected to improve repayment rates while significantly reducing the financial burden on borrowers, creating positive ripple effects throughout the economy.

That’s it; that’s my Bill to fix student loans completely. You shouldn’t have to pay interest to these loan servicers for borrowing money from the government. We already pay out the rear end for taxes, and now, students are bent over and getting destroyed by compounding daily interest rates.