Looking to add some shows to my info network and Badlands pops up quite often on here. I just found out you can download the shows as a podcast so i can download and listen while I'm doing other chores.

Badlands Media https://badlandsmedia.podbean.com

RSS address: https://feed.podbean.com/badlandsmedia/feed.xml

What are the top 3 shows you would recommend? What are these shows about?

Which ones would you say consistently give new and useful information to learn from?

Thank you for your answers

This book and documentary details the legal taking of ALL STOCKS, BONDS, SECURITIES WORLDWIDE.

IF YOU BOUGHT A BOND, STOCK, OR ANY SECURITY, YOU DON'T OWN IT!

The Great Taking is highly researched and cites laws in the USA and European Union that have been designed to subvert our financial system and take everything you own without a day in court in the event of a global financial meltdown (which has been planned!)

The Great Taking - Documentary

https://www.youtube.com/watch?v=dk3AVceraTI

A 1hr 10min summary of the book "The Great Taking" by the author himself. I recommend everyone watch or listen to. When David starts talking about very technical details, I'd recommend playing at 0.75 speed.

Here's where you can buy the book for The Great Taking. There's a free downloadable PDF available as well.

Archived Zip File of all references from "The Great Taking" minus [48], [27] (Video has been scrubbed) and [10] (Don't have an electronic copy of the '87 book)

165 MB

https://files.catbox.moe/6pxbwr.zip

Full [48] is too big to be included in a catbox.moe link, It hasn't been scrubbed off YouTube yet. (October-19-2020) Cross-Border Payment -- A Vision for the Future | IMF

https://www.youtube.com/watch?v=mVmKN4DSu3g

Source [4] from the book is a reply from the New York Federal Reserve to the European Commission that cites the Uniform Commercial Code (UCC) Article 8 and 9 as the legal right to take all of your security investments.

A link to the source is here

https://archive.org/details/ec-clearing-questionnaire/page/19/mode/2up

Page 3

(0) In respect of what legal system are the following answers given?

This response confines itself to U.S. commercial law, primarily Article 8, specifically Part 5 of Article 8, and parts of Article 9, of the Uniform Commercial Code (“UCC”);

Page 9

(10) Where securities are held in pooled form (e.g. a collective securities position, rather than segregated individual positions per person), does the investor have rights attaching to particular securities in the pool?

No. The security entitlement holder does not have rights attaching to particular securities in the pool, he has a pro rata share of the interests in the financial asset held by its securities intermediary to the amount needed to satisfy the aggregate claims of the entitlement holders in that issue. This is true even if investor positions are “segregated.”

The Questionaire before being answered is here:

https://files.catbox.moe/70jgri.pdf

U.c.c. - Article 8 - Investment Securities (1994) can be found herehttps://www.law.cornell.edu/ucc/8

U.c.c. - Article 9 - Secured Transactions (2010) can be found herehttps://www.law.cornell.edu/ucc/9

Extra research on the person David Rogers Webb - Author of "The Great Taking"

EXTRA-on-David-Rogers-Webb.zip 73.2 MB

https://files.catbox.moe/24nvf2.zip

NEW! Sources from The Great Taking Documentary that was created by David Rogers Webb himself! These sources in addition to the ones in the book. TIME-STAMPED IN THE FILE NAME FOR THE EXACT TIME SHOWN IN THE DOCUMENTARY. PINPOINTS EXACT LAWS AND DOCS TO READ! DOWNLOAD THE ZIP FILE FOR OFFLINE VIEWING. PLEASE TAKE A LOOK ANONS

Format: HH-MM-SS

The Great Taking Documentary Sources.zip 160 MB

PREVIOUS POST IN CASE YOU MISSED IT

"How I think the next Great Depression might start"

https://greatawakening.win/p/17rSsfoV8B/heres-how-i-think-the-next-great/

Feel free to discuss or share anything I might've missed!

CENTRAL BANK NEWS

The Bank of Japan has been doing some wild things recently with monetary policy.

But how has it affected the US Treasury market? And perhaps more importantly, are the BoJ's antics a sign of what's to come from our own Fed?

Time for a Debt 🧵👇

https://twitter.com/jameslavish/status/1720395436702543874

REPOST - The Bank of Japan Could Still Trigger a Stock Market Crash. Here’s How. A weakening yen could trigger margin calls around the world from the end of the Carry Trade

https://leadlagreport.co/tiyenb

The Impact of Japan on Global Stock Market: Exclusive Interview with Weston Nakamura | Lead Lag Report

https://www.youtube.com/watch?v=KKzk8wRTDuU

12:20 Carry Trade info

This monthly USDJPY chart is wild! Looks the USDJPY was pushed below 150 again last night

https://www.tradingview.com/symbols/USDJPY/

Keep a watch on it, if it goes above 158, expect to start seeing a Global Margin Call selling back all the carry trade positions. The snowball turns into an avalanche that brings down the world economy.

Bank of International Settlements will be co-host of #DCFintechWeek on 6-9 Nov talking about #CrossBorderPayments #AI #RegTech #SupTech #CBDCs

Programme at: https://dcfintechweek.org/agenda-2023-3/

https://twitter.com/BIS_org/status/1720517725091410119

If you’ve never heard of a debt spiral, it’s time you did,

and ask the question, "is the US already in one?"

Let’s dig in and answer that.

A debt 🧵👇

https://twitter.com/jameslavish/status/1562078782453792768

Sweden's central bank needs a taxpayer bailout.

Joining the Bank of England who got $35 billion last year as central bankers come for taxpayers who are beyond tapped out.

The numbers for the Fed are a lot bigger -- over a trillion in the hole.

https://twitter.com/profstonge/status/1718606104832221251

Swedish Rekt Bank | Bitcoin University

https://www.youtube.com/watch?v=5d2BopwH-CI

In this video, I discuss the Swedish central bank (Sveriges Riksbank) blowing itself up through its own incompetence and needing a $7 billion bailout.

The Swedish central bank goes bust, comes in for a $7 billion taxpayer bailout.

Given Sweden's size, that's $260 billion in relative US terms. In one year. Of course piled on top of Sweden's deficit.

We'll see a lot more of this to come. In fact, the Fed's well past bankrupt, with $1 trillion in negative equity. Silicon Valley Bank got wound up when it was $20 billion in the hole. The Fed just redefines accounting definitions while sticking taxpayers with the bill.

https://twitter.com/WallStreetSilv/status/1718632184322396374

The Swiss Central Bank posts 12 Billion Franc ($13.36 Billion) Q3 loss

Who bought up Credit Suisse earlier this year when it failed? The Central Bank of Switzerland

Interesting chart by Hussman. estimates the Fed is insolvent by $2.5T. wow. @hussmanjp

https://twitter.com/LawrenceLepard/status/1720147722974445976

Bank of England rate is maintained at 5.25% - November 2023 https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2023/november-2023

🟡Central Bank Gold Binge Is Even Bigger Than Previously Thought🟡

https://finance.yahoo.com/news/central-bank-gold-binge-even-060000811.html

BANK NEWS

@peruvian_bull

are banks hiding naked shorts in custom basket swaps?

https://twitter.com/peruvian_bull/status/1720196192515109338

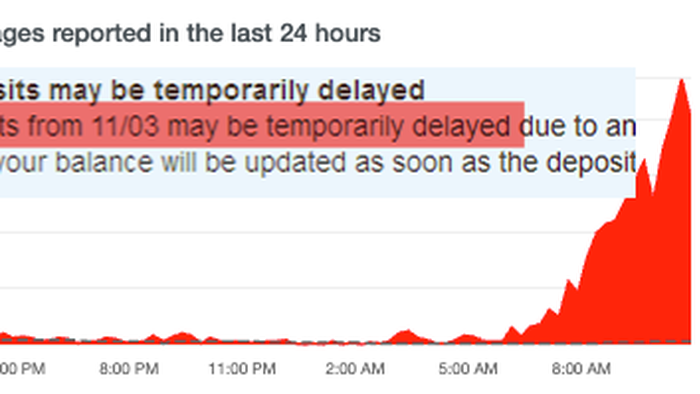

"Some Deposits May Be Temporarily Delayed": Downdetector Shows Service Disruptions At US Banks on Friday

Seems the bank issues were a technical glitch with the Federal Reserve system.

https://twitter.com/FinanceLancelot/status/1720473096686104721

JP Morgan having "glitches" in its $1 Trillion money market fund

https://twitter.com/DarioCpx/status/1720040645967204435

(1 Month Ago) 🚨Another Money Market fund goes bust, it’s $C this time 👀🚨

https://twitter.com/DarioCpx/status/1709041599387443205

Repo Madness Hits China, Japan Rolls Out Stimulus Package | Nobody Special Finance

https://www.youtube.com/watch?v=7ZOwjj4lOsA

Overnight interbank lending rates in China have spiked as a flood of new bond supply increased demand for cash even as fears of developer defaults made banks hesitant to lend.

🚨3 DAYS AGO THE #DTCC PUT OUT A WEIRDER NOTICE TO REMIND MEMBERS THEY HAVE 1 BUSINESS DAY TO DECLARE A “REPORTABLE EVENT” 🚨

https://twitter.com/DarioCpx/status/1719904449437839666

Another bank bites the dust. Citizens Bank, Sac City, Iowa

https://twitter.com/kurtsaltrichter/status/1720618008865882113

Iowa Trust & Savings Bank, Emmetsburg, Iowa, Assumes All of the Deposits of Citizens Bank, Sac City, Iowa

https://www.fdic.gov/news/press-releases/2023/pr23091.html

Barclays is sued over ex-CEO's ties to Jeffrey Epstein

https://www.reuters.com/legal/barclays-is-sued-over-ex-ceos-ties-jeffrey-epstein-2023-11-03/

Sam Bankman-Fried is found guilty as you all know.

https://twitter.com/BartsQuandry/status/1720262425482805612

@FTX_Official

(Over 1 year ago) Upcoming listing on FTX: Japanese Yen $JPY perpetual futures!

Live on October 27, 2022 at 2pm (UTC) Listing details: http://help.ftx.com/hc/en-us/articles/10358687088788

https://twitter.com/FTX_Official/status/1585270034460422145

Former Goldman Trader Gets 36 Months In Jail For Netting $280,000 From Insider Trades

https://www.zerohedge.com/markets/former-goldman-trader-gets-36-months-jail-insider-trading

WHAT's GOING ON AT APPLE? AND OTHER STOCK/ECONOMIC NEWS

(6 months ago) Is $AAPL a tech company or a shadow bank? And if they are a shadow bank is everything ok there? I know it sounds crazy, but something is quite odd with their structure and their numbers.

https://twitter.com/DarioCpx/status/1658421099867279361

(Aug-2018) WSJ - Apple Is a Hedge Fund That Makes Phones

🚨BEWARE OF A TOO SHINY #APPLE🍎 , IT MIGHT BE “FAKE” PLASTIC ONE🚨

https://twitter.com/DarioCpx/status/1719891765157933203

Five months ago, I put forward the question, "Is $AAPL a shadow bank?" [x.com/dariocpx/statu… ] And now, with less than 24 hours away from yet another Tim "Trillions" Cook show of financial engineering wizardry, it is worth going one step further to understand whether Apple today is making the same mistakes that almost brought General Electric to its knees in 2008...

🚨 LADIES AND GENTLEMEN, $AAPL IS COOKING THE BOOKS! 🚨

https://twitter.com/DarioCpx/status/1720180285067911195

🚨 IS GEODE CAPITAL MANAGEMENT LLC THE “WHALE” THAT CONTINUES TO SQUEEZE #STOCKS HIGHER AND CRUSH THE $VIX?! 🚨

Golden Nuggets 1-16, a must read!

https://twitter.com/DarioCpx/status/1720246250971509206

Market Celebrates Horrible Jobs Report. | Nobody Special Finance

https://www.youtube.com/watch?v=jPTAk4rKeg0

Stocks, bonds, and commodities are all celebrating what can only be described as a terrible jobs report from the US Bureau of Labor Statistics. The economy added 150,000 jobs in the month of October, below the 180,000 expected. But the really bad news is hidden beneath the headlines.

How have other 6-day >6% rallies looked the last few decades?

A 🧵

October 1997...

https://twitter.com/jojoeb16/status/1720485840768348218

Gold is now outperforming the S&P 500 this year

https://twitter.com/WinfieldSmart/status/1717955748783657256

Credit card debt is about 0.6% of total household assets.

There's about $1 trillion in credit card debt and $160 trillion in household assets.

https://twitter.com/LynAldenContact/status/1719881040842445072

@WinfieldSmart

AMAZING VISUALIZATION

120+ YEARS of GLOBAL 🌎 STOCKS vs. GLOBAL 🌎 ECONOMIES

https://twitter.com/WinfieldSmart/status/1720175487211753831

Great twitter account to follow

Great visualization of the Regional Bank Crisis March-28-2023 to April-4-2023

https://twitter.com/WinfieldSmart/status/1654785059864363008

On CNBC with Drunkenmiller - “My generation… we’ve given nothing. We’ve given nothing! And now we want to screw our grandchildren…

We’ve got to stop guys, we’re DRUNK.”

https://twitter.com/FinanceLancelot/status/1719851813757669548

Americans Panic Search "Give Car Back" As Subprime Auto Loan Delinquency Erupts

Auto Loan Industry Is Going From Bad to Worse: ‘Everyone’s Getting Out’

Veteran financial analyst @HedgeyeFIG addressed unsettling news from Credit Acceptance Corp $CACC and what it means for the overall lending environment this morning on The Call @Hedgeye with CEO @KeithMcCullough.