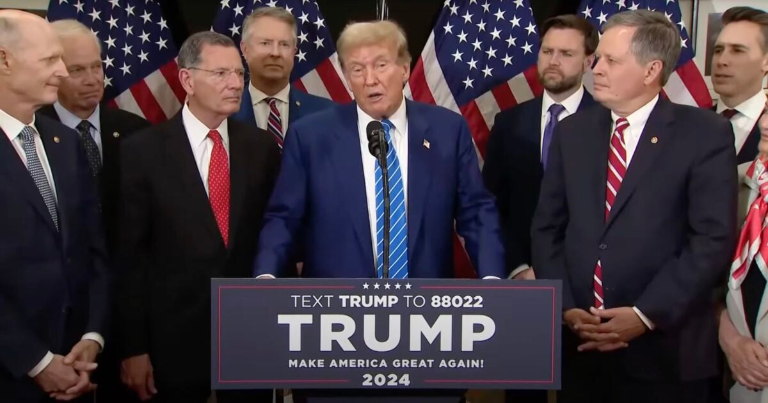

💥🦁💰 Trump Drops Bombshell Proposal: Allegedly Suggests Eliminating Income Tax in Favor of High Import Tariffs During DC Republicans Meeting 💥🦁💰

(www.thegatewaypundit.com)

🏁 - A WINNING MOVE - 🏆

Property tax going away would be the best of all. Maybe start slow and make it so you don't get taxed in a flexible capacity years after you buy your home.

Start it at precisely the rate you paid upon purchase. Then go down...not up.

Nothing pisses me off more than when the county comes in and assesses your property valuation at 3x what you paid for it because someone paid that much for a house in your neighborhood. I bought in an affluent area in North Texas back in 2013…2000sq ft, 1/2 acre tree lot with a pool…paid 208k for that house, now my property taxes are valued at 600k. We bought because it made sense and didn’t want to be house poor, now 11 years later the house payment is almost 500.00 more a month, just on property taxes. It’s beyond insane.

It sucks because it's also rigged. When does valuation ever go down? It doesn't. It only ever goes up.

Even if it's a semi-permanent change, having your payments go down over time depending on how long you've owned the property makes a ton of sense on many different levels, and it incentivizes owners to stay at and improve their homes rather than leaving, which makes the neighborhood look better.