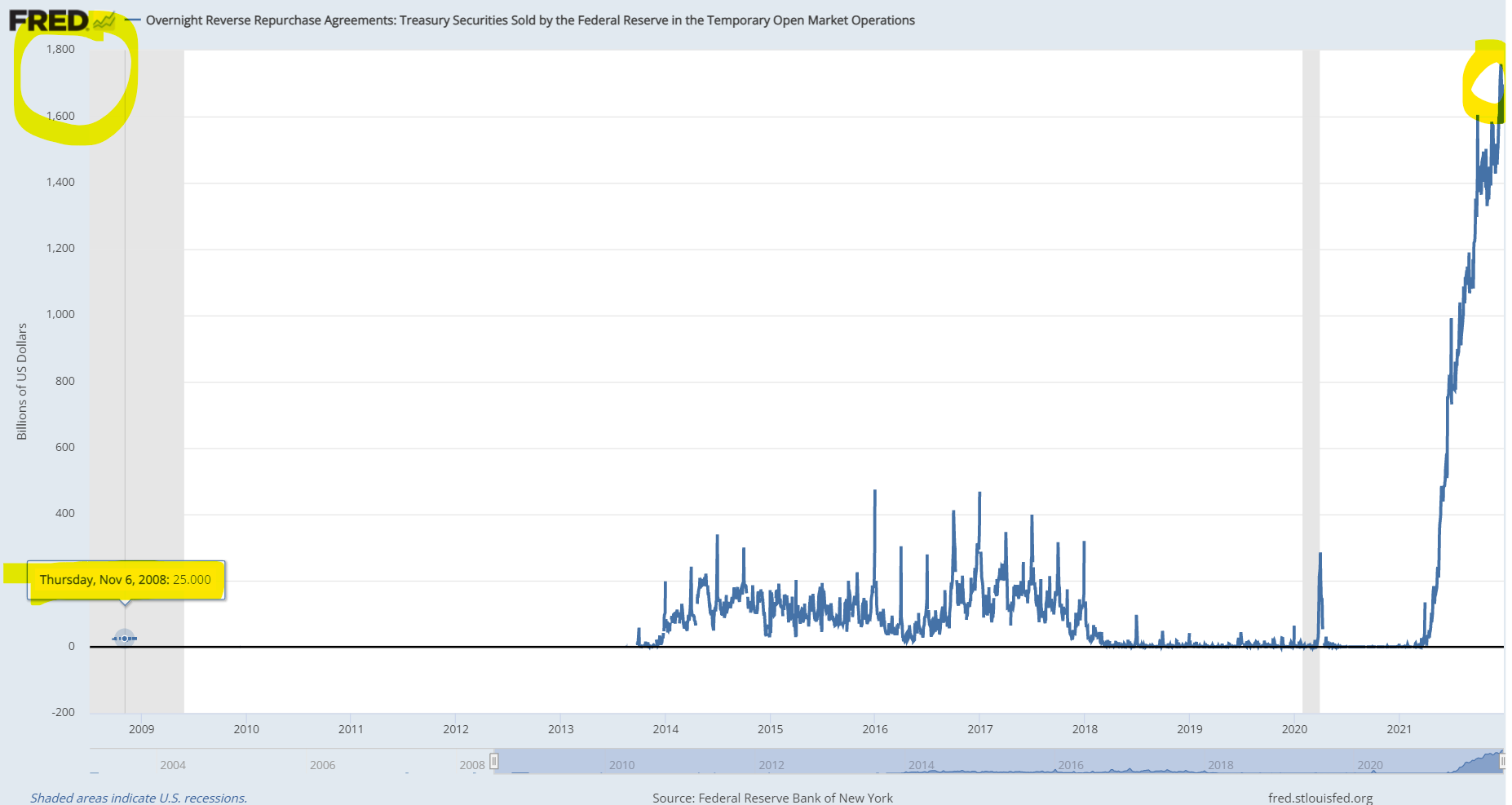

Reverse Repo is staggering (Thanks to Anon who posted the original!) - This looks all the way back to 2008. Which barely shows up on the radar. Back during that last big recession we saw $25 billion reverse repo... now we're seeing $1.7+ TRILLION in reverse repo.

(media.communities.win)

👀 EYES ON! 👀

What is the purpose of a reverse repo?

A reverse repo is a short-term agreement to purchase securities in order to sell them back at a slightly higher price. Repos and reverse repos are used for short-term borrowing and lending, often overnight. Central banks use reverse repos to add money to the money supply via open market operations.

Reverse repos are commonly used by businesses like lending institutions or investors to lend short-term capital to other businesses during cash flow issues. In essence, the lender buys a business asset, equipment or even shares in the seller's company and at a set future time, sells the asset back for a higher price.

Oh no... it's much worse my friend. The Reverse Repo market is literally lenders and major financial institutions taking insanely high volume/high speed loans out.

It would be like getting into extreme gambling debt. Waiting until you were like $100,000 in debt... and then borrowing back the entire amount you couldn't pay back at a higher price, to resell that back to the 2nd lender, at a higher price. Or else you will just accumulate more debt each day. Until you owed millions you can not afford.

I believe this applies to not only lending institutions, but perhaps even Hedge Funds (possibly indirectly via large lending institutions).

Basically, the economy is absolutely fucked and PANIC is in full swing.

So who are these businesses borrowing the money from? Obviously it's from a company(s) that has a LOT of capitol to play with. Here's few that might fill the bill: Blackrock Vanguard State Street

Apparently these three companies own the majority of Corporate America. And if that's true then why would anyone actually need a reverse repo in the first place? To cause a massive financial crisis for the regular American Citizen? Just hustling money around for their own benefit.

Could the FED be doing a favor to some company by buying its stock and selling it back for more later - as that would halt its drop in stock price and give the company a higher stock price later?

This sounds like it might be a way for the powers that be to pick and choose what stocks are propped up, and thus subject to graft. Am I wrong?

I am not knowledgable in this area but this scheme sounded plausible.