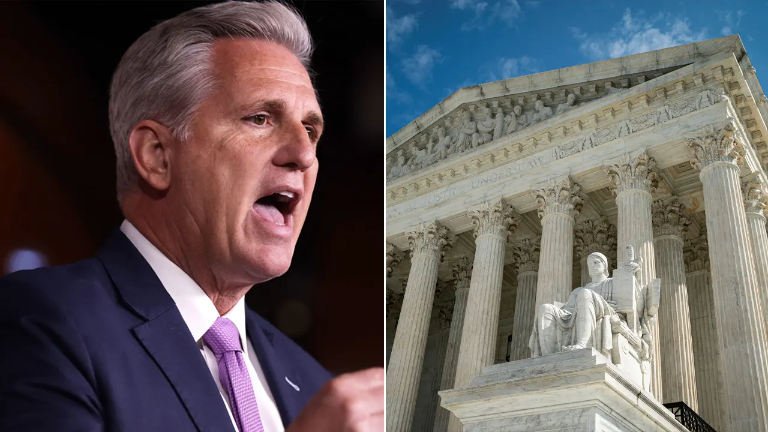

House Voted To Overturn SCOTUS Ruling That Extended The Executive Branch's Power, Nullifying Chevron U.S.A., Inc. v. Natural Resources Defense Council, Inc.

(patriotbarbie.com)

🌶️ - S P I C Y - 🌶️

Comments (8)

sorted by:

Can someone explain the implications

Humpty Dumpty Poopy Pants argues the agencies that write regulations do so because they are experts in the subjects they are agencies for. ATF, EPA, etc. However, the courts are supposed to check this as these regulations are not laws, even though they carry the same weight. the latest pistol brace ban by the ATF is a perfect example. The republicans argue there is not enough oversight by courts because the Chevron case instructs courts to defer to the Federal agencies instead of the law.

The ATF just made millions of law abiding citizens felons at the beginning of this month. The ATF is a law enforcement agency, it does NOT make laws. Yet because of their responsibility to enforce the NFA, they can unilaterally decide to add whatever they want to the NFA (pistol brace) and turn anyone who owns them into a felon. Classic government overreach.

This will probably not pass the Senate, and even if it does the potato will veto, so probably symbolic and therefore no implications.

Thank you! As the article below states, it may be a fait accompli anyway, since the SCOTUS may well overturn that ruling themselves when they take it up.

https://www.foxnews.com/politics/house-strikes-blow-federal-regulations-votes-overturn-controversial-supreme-court-ruling

(and yes, I know it's Fox , so who knows how reliable it is, but Roe v. Wade was overturned.... :)

Thank you

They did the same with bump stocks, which was eventually overturned.

It's a good bill. Probably won't become law.

If it passes, it means that 3-letter agencies can't add regulations that congress didn't actually include in the law. They do it a lot and abuse their authority.

Previous supreme court ruling basically set a default "defer to the agency" in case of doubt, which allows them to avoid doing their job, which is to interpret the law.

General Implications:

https://www.law.cornell.edu/uscode/text/18/2384

If you ask your Corporate employer to correctly classify your labor capital on your W-2 by taking it all out of Box 1, and they refuse, you have standing to sue them and make it a class action for all current, former, and previous employees of all acquired companies. Suggested damages is all back payroll taxes, plus "loss of use" of stolen capital damages, plus 12.666% compound interest. These damages may be large enough to effectively liquidate or force into bankruptcy 90% of large US Corps. Also include all current Directors and request seizure of all their assets first to pay all claims prior to liquidation of Corporate assets, as Directors ae individually liable for Constitutional violations and accounting fraud.

Theft of individual property such as labor capital violates the 4th Amendment as well. Use form 4852 and amended return to request all payroll taxes back from IRS for last 5 years. They have granted all of my requests so far. Once you get past 5 years you may have to sue if they refuse to return the payroll taxes. But please put your assets into a Trust before you sue them.

(Ruling was from the 1980's)