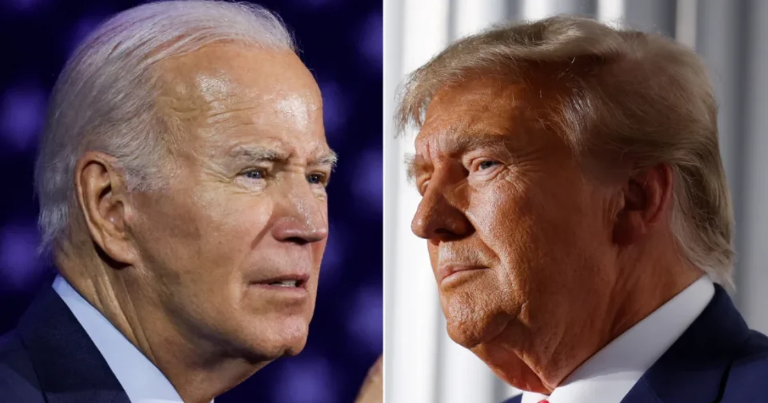

Trump to Immediately Unwind Joe Biden’s Unconstitutional Student Loan Forgiveness Plan

(www.thegatewaypundit.com)

You're viewing a single comment thread. View all comments, or full comment thread.

Comments (58)

sorted by:

I earned two BAs, 2 MAs, and an Ed.D. and all of it was paid for by my labor. I came from low rent housing after my dad walked away when I was two, and my mom never applied for welfare even though others in our circle did. She taught me hard work and paying your own way. And kid that feels it’s alright for someone to pay their way, even the society says they’re adults, will never have my respect.

That’s great buddy good for you. Too bad the system doesn’t work that way anymore.

An entire system taking away financial literacy classes then telling 3/4 generations of kids that they won’t become anything in life unless they take out $100,000 minimum in student loans.

Promising said kids that they will become successful immediately after college. Then come to find out those jobs aren’t there.

And lets say you do find a job in your field. And you start paying your loans back. Over the course of 10-15 years you find that the interest on the loan made the loan even higher than what you took out.

The student loan system was designed to be predatory.

Nobody is calling for car loan forgiveness or mortgage forgiveness. Or even small business loan forgiveness.

The entire student loan system is rotten to begin with.

Now is the solution for the taxpayer to bare the burden? No. Similar to how we shouldn’t bail out the airlines. But the government is never going to be able to collect all that money back. They can seize the assets of the universities that knowingly inflate their tuition costs for the simple fact they want the subsidies but good luck trying to collect on this debt.

And if we really are going to a new currency or a new government, this whole debacle won’t even matter

Exactly, I'm 41 and still paying my wife's and my student loans off (at 8% albeit). While there may be exceptions as the gentleman above (Berlin); it is frustrating that we have had to pay while others do not.

Furthermore, anything that is free you don't really ever know the true value of it. Because we had to pay our way def gives us a different appreciation than someone who's loans were forgiven.

I'm a little skeptical as to how this would go through but it would be nice to see it happen. Loan forgiveness was a contributing factor to inflation we are currently trying to digest (on top of all the rounds of stimulus checks)

I have a Bachelor and a Master. I took out a total of 78k in loans, paid faithfully every month, have paid faithfully every month, and now I owe over 110k... the interest is what kills people, not the payments.

I only have to make roughly 70 more payments, and my loans will be completely forgiven, do I think that is right? Hell no. But at the same time, it's not right that these loan servicers are getting rich off of what amounts to our tax dollars to begin with.

YES! Exactly! I'm sick of the victim blaming with this corrupt system.

I pay my rent no problem. I pay my car bill (which sucks cuz its only cuz I was in an accident and had to get a new one). I pay my utilities. Nobody here is calling for car loan cancellation. We get a near immediate return on our investment and we KNOW how much we’re paying at the end of it all.

All the student loan bs is insane. And colleges know damn well half their degrees aren’t worth even $10,000 let alone $50,000

This right here.

I wrote an actual Bill on Policies for People that would take care of the student loan crisis... the issue is getting one of our useless ass lawmakers to put it forward.

A BILL

To amend the Higher Education Act of 1965 to eliminate interest charges on federal student loans and to provide relief for existing borrowers.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,

SECTION 1. SHORT TITLE.

This Act may be cited as the “Student Loan Interest Elimination Act of 2024”.

SECTION 2. FINDINGS.

Congress finds the following:

(1) The total outstanding student loan debt in the United States exceeds $1.7 trillion.

(2) The average student loan borrower graduates with approximately $37,000 in debt.

(3) Interest accumulation on student loans significantly increases the total amount borrowers must repay, often resulting in loan balances that grow larger despite regular payments.

(4) Student loan debt disproportionately affects low-income and minority borrowers, contributing to wealth inequality.

(5) High student loan payments prevent many Americans from purchasing homes, starting businesses, saving for retirement, or participating fully in the economy.

(6) The current system of charging interest on student loans creates a significant barrier to economic mobility and financial stability for millions of Americans.

SECTION 3. ELIMINATION OF INTEREST ON FEDERAL STUDENT LOANS.

(a) IN GENERAL.—Section 455 of the Higher Education Act of 1965 (20 U.S.C. 1087e) is amended by adding at the end the following:

"(r) ELIMINATION OF INTEREST.— "(1) Notwithstanding any other provision of this Act, effective immediately upon enactment, the Secretary shall not charge interest on any loan made under this part. "(2) For loans made prior to the date of enactment of this subsection, any outstanding interest shall be— "(A) immediately frozen upon enactment; "(B) segregated from the principal balance; and "(C) forgiven upon completion of 24 consecutive, on-time monthly payments.

(b) CONFORMING AMENDMENTS.— (1) All references to interest rates in the Higher Education Act of 1965 shall be interpreted as requiring a zero percent interest rate for federal student loans. (2) The Secretary shall update all loan documentation, materials, and systems to reflect the elimination of interest charges.

SECTION 4. BORROWER RELIEF AND IMPLEMENTATION.

(a) BORROWER NOTIFICATION.— (1) Within 30 days of enactment, the Secretary shall notify all current federal student loan borrowers of— (A) the elimination of interest charges on their loans; (B) the segregation of existing interest from principal; and (C) the requirements for interest forgiveness.

(b) SERVICER REQUIREMENTS.— (1) Loan servicers shall— (A) immediately cease charging interest on all federal student loans; (B) update their systems within 60 days to reflect the changes required by this Act; (C) provide updated loan statements showing separate principal and legacy interest amounts; and (D) implement tracking systems for the 24-month interest forgiveness program.

(c) BORROWER PROTECTIONS.— (1) No borrower shall be required to make payments on segregated interest until completing the 24-month program. (2) Any amounts paid toward interest during the implementation period shall be credited to principal. (3) Borrowers in default shall be eligible for interest elimination upon entering a rehabilitation program.

SECTION 5. FUNDING AND OFFSET PROVISIONS.

(a) AUTHORIZATION OF APPROPRIATIONS.— (1) There are authorized to be appropriated such sums as may be necessary to carry out this Act. (2) The Secretary shall submit annual reports to Congress detailing the costs associated with interest elimination.

(b) OFFSET.— (1) The Secretary of the Treasury shall conduct a study identifying potential revenue sources to offset the cost of interest elimination, including but not limited to: (A) Financial transaction taxes (B) Corporate tax reform (C) Wealth taxes (D) Reduced administrative costs from simplified loan servicing

SECTION 6. EFFECTIVE DATE.

This Act shall take effect immediately upon enactment.

SECTION-BY-SECTION ANALYSIS

Benefits and Rationale:

Immediate Financial Relief Eliminates ongoing interest accumulation on all federal student loans Provides a path to forgiveness of existing interest through consistent payment Reduces monthly payment amounts for millions of borrowers Prevents loan balances from growing due to interest capitalization Economic Stimulus Increases disposable income for approximately 45 million borrowers Enables increased consumer spending and investment Facilitates home ownership and business formation Improves retirement savings capacity Stimulates job creation through increased economic activity Social Equity Reduces the disproportionate impact of student debt on low-income borrowers Narrows the racial wealth gap Improves social mobility Makes higher education more accessible and affordable Simplified Loan Servicing Reduces administrative complexity Decreases servicing costs Improves borrower understanding of loan terms Reduces errors and disputes Educational Access Removes financial barriers to higher education Encourages pursuit of public service careers Reduces dropout rates due to financial stress Promotes workforce development Mental Health Benefits Reduces stress and anxiety related to growing debt burdens Improves overall well-being of borrowers Enables better work-life balance Reduces depression and other mental health impacts Family Formation Enables younger Americans to start families earlier Improves ability to save for children’s education Facilitates multi-generational wealth building Supports housing stability for families Market Effects Increases small business formation Improves housing market participation Enables greater workforce mobility Stimulates innovation and entrepreneurship Fiscal Responsibility Reduces default rates Improves loan repayment rates Decreases collection costs Simplifies budget planning for borrowers Long-term Economic Growth Increases human capital investment Improves labor market efficiency Supports innovation and productivity Strengthens middle class growth Implementation Timeline:

Phase 1: Immediate Implementation (0-30 days)

Interest charges cease on all federal student loans Borrower notification process begins Servicer system updates initiated Phase 2: System Updates (31-60 days)

Loan servicer systems fully updated New statement formats implemented Interest segregation completed Phase 3: Interest Forgiveness Program (Months 3-24)

Tracking of consecutive payments begins Interest forgiveness process implemented Progress reporting system established Phase 4: Long-term Monitoring (Ongoing)

Cost assessment and reporting Economic impact studies Program effectiveness evaluation Conclusion:

The Student Loan Interest Elimination Act represents a transformative approach to addressing the student debt crisis while maintaining the principle of loan repayment. By eliminating interest charges while preserving the obligation to repay principal, this legislation strikes a balance between providing necessary relief to borrowers and maintaining fiscal responsibility.

The Act’s implementation is designed to provide immediate relief while establishing a sustainable long-term solution to the student debt crisis. Through careful planning and phased implementation, the legislation ensures that both borrowers and loan servicers can adapt to the new system while maximizing the economic and social benefits of interest elimination.

The combination of immediate interest elimination and a path to legacy interest forgiveness provides both instant relief and an incentive for consistent loan repayment. This approach is expected to improve repayment rates while significantly reducing the financial burden on borrowers, creating positive ripple effects throughout the economy.

That’s it; that’s my Bill to fix student loans completely. You shouldn’t have to pay interest to these loan servicers for borrowing money from the government. We already pay out the rear end for taxes, and now, students are bent over and getting destroyed by compounding daily interest rates.

It can be done today and I have seen kids who work hard and sacrifice now for a better life later and never take out a loan.

No bud, it can't be done that way any longer. For what you paid for your 2 BAs, 2MAs and an ED.D, you might get 1 Bachelors if you're lucky and that's with going to community college. The education system is so fucked that no one can afford it any longer.

Agreed...very hard to do this today Berlin. Times have changed

I have former students who are doing it.

Again, glad to hear that. Doesn’t change anything I said about the entire system being predatory on young kids who don’t know what they’re signing up for

That’s the time parents need to be involved.

Who would downvote a comment about kids today working hard to get a degree that they pay for?

Because OP is trying to say because he was able to pay it that means anyone should be able to pay it when while that SHOULD be the case, it is not.