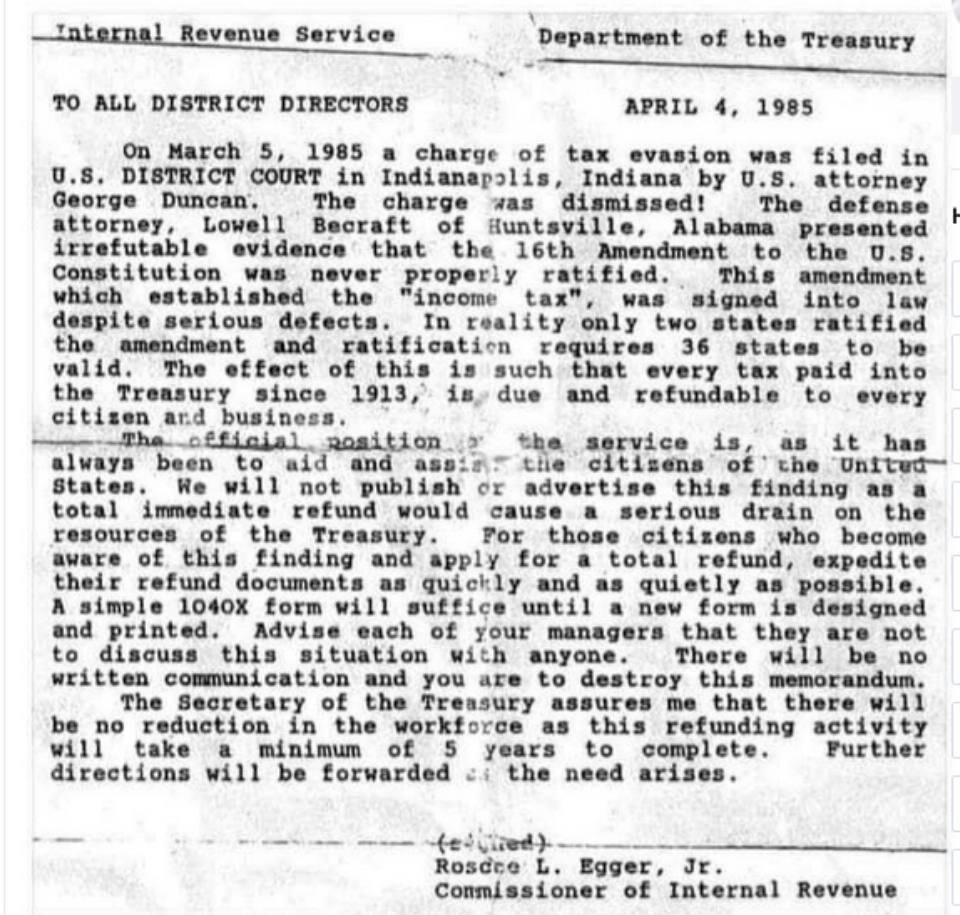

GIANT IRS BOMBSHELL! Leaked 1985 Letter from IRS Commissioner EXPOSES the 16th Amendment as a FRAUD – Income Tax Was NEVER Legal! "needs research"

(media.greatawakening.win)

🧐 Research Wanted 🤔

They knew this and still threw people in jail for not paying.

That's our Government....

Knowingly

You guys realize its April 1st right?

🤣🤣

Trump has called April 2nd LIBERATION DAY...

fucks sake, this should be clearly tagged as a shitpost if youre gonna post this kind of hopium on april fools!!

GIANT IRS BOMBSHELL! Leaked 1985 Letter from IRS Commissioner EXPOSES the 16th Amendment as a FRAUD – Income Tax Was NEVER Legal! $330 TRILLION STOLEN – WE MUST FIGHT BACK! Please read.

THE PATH TO JUSTICE: WHAT YOU MUST DO NOW!

President Trump has made it clear: The IRS must be dismantled. He’s the ONLY leader in modern history who has the courage to stand against this deep-state extortion racket. But he needs us to stand with him!

oh i am sure we are 110% behind him on this...... screw the libs they can keep paying

This has been posted before.

IRS

Works for me...

This is fake and gay.

The trial was United States vs Jane R Ferguson.

Ferguson appealed her conviction and lost a 2nd time.

https://law.resource.org/pub/us/case/reporter/F2/793/793.F2d.828.85-1688.html

Yea this....

I pay taxes on my job and they come out every check. I do not own any side businesses nor do i pay out any 1099's. I have not filed taxes in over 7 years. They have never said anything and they won't.

If you don't owe anything they won't complain... they are more than happy to not pay any possible refunds.

Not sharpshooting, just sayin'

True, they are only worried about people who owe money not people the IRS owes a refund.

Hope you continue to get lucky

They tend to leave you alone if you're a small fish. You'll find you can't get a 3% down home loan though because that's a federal program and they want to see your returns to qualify. When you realize the straight story of all this, do yourself a favor and keep it to yourself. If you're young, you might be wise to play along with the game unless you don't mind retiring on the streets

Im older and debt free. Own my house and property. And i don't like playing along with crooked games

Yeah, but if the house is in your name they could still make you defend yourself. Even if you win it could cost you everything. If your assets are in a trust, you might be ok .

I am questioning this document’s validity(?) The National Archives Catalog’s website has scanned letters of ratification from 48 states. That would be enough according to the two thirds rule.

What you should question is the validity of the 16th Amendment and its ratification.

Ratification of an amendment to the US Constitution is an extremely precise, detailed, and intricate procedure that absolutely must be followed to the letter, without exception, or the Constitution is not amended.

If you read in depth about the so-called "ratification", it becomes clear the amendment was not properly ratified and therefore is without force and effect.

What source are you referring to that makes it clear that the ratification wasn’t properly done? I am genuinely curious about it which led me to the source I mentioned. All 48 states that signed/sealed are on record. I’m not a legal professional but it was pretty clearly stated. The reason I questioned the document in the first place was because the concern that many who took it at face value would file amended returns back to the first day of their employment. That would put a big fat bullseye on them. Until the IRS is abolished, it would not be pleasant for anyone in that position. Where can I find the contradicting information you are referring to?

Your statementis wise, very few people win, best to wait until IRS is abolished. I focus on GAW core issues now. But here’s for you the summary on Bill Benson’s research.

Bill Benson went to the states archives and compiled his research in ”The Law that Never Was” volumes 1 and 2. https://www.thelawthatneverwas.com/. I’m not sure you can get these books anywhere, but I read volume 1 in the past.

We don’t get to hear about this because “the government” called him a *tax protester” instead of evaluating the merits of his research. https://caselaw.findlaw.com/court/us-7th-circuit/1137787.html

Here’s Devvy Kidd’s major point that the injunction against Bill Benson ignored wrongfully an important principle from 7th Circuit Court of Appeals https://www.newswithviews.com/Devvy/kidd142.htm (Devvy’s a great activist, knowledgeable, excellent writer, I was introduced to her once by phone).

I have read them, detractors say that the discrepancies are minor typographical errors and that there are only clerical errors that state legislators and legislatures made during the ratification / rejection process of the 16th amendmen. . Benson’s detractors are wrong. There are some substantive errors made, and some minor clerical mistakes, a mix.

The government also might not have told the truth on the 17th amendment.. https://www.devvy.com/new_site/17th_amendment_docs_march_2010.html

Many of those letters are like, we concur if there are these changes according to some research I've heard. Additionally there are two supreme court cases that said the amendment did not grant the federal government any new tax authority. Watch "from freedom to fascism", it is a pretty good synopsis

but its a bombshell

I hate when people post this type of "Hopeum" here! What good does it do and all it does is injure credibility overall! This is fake! I do believe that taxation on income is Constitutionally illegal and for the reasons this letter says, however, I still believe the letter is fake.

Did you even read what Anons dug up on it ???

I want ALL my fucking money back.

Lump sum / untaxed

Ratified or not, it's still taxation without representation and therefore illegal under our Constitution... and likely why the IRS has never once been audited since it's inception. Same with the Federal Reserve

I've been opted out of Federal income tax for about a month now. My take home pay is $400 more. Not filing anymore either. Feels good brah.

I did this in 2001. In 2014 the IRS contacted me and said I owed them $130,000. I still didn't pay. By mid 2014 they seized my bank account and garnished my paycheck. They took all but $400 from each check. I figured I could fight this by getting a second and third job. Within weeks they discovered those jobs and garnished all of those wages as well. In the end I had to pay the entire $130,000 back plus interest and more penalties.

They're blood sucking thieves.

I know someone who did something like that. She did some sorta on line course on that. She wrote these letters declaring herself something or another to various authorities. At one point the local police came for all her guns. I think she still doesn't pay taxes though. IDK I stopped asking

Not trying to black pill, I do think Trump will get to the IRS at some point but I just want to point out what know from talking to someone I know

"She wrote these letters declaring herself something or another to various authorities"

Did she declare herself a "sovereign citizen?"

something like that. IDK exactly. Is that what you did?

I think losthorizons.com MAY be the proper way to do this. (not pay) I'm too chicken.

Until they catch and punish you, which I hope never happens.

Some context: https://historyheist.com/glossary/amendment-16/

On June 17th, 1909, United States Senator Norris Brown of Nebraska proposed the Sixteenth Amendment to the U.S. Constitution. It was allegedly fraudulently ratified on February 25th, 1913. The federal government rests its authority to collect income tax on the 16th Amendment to the U.S. Constitution—the federal income tax amendment.

After an extensive year-long nationwide research project, William J. Benson discovered that the 16th Amendment was not ratified by the requisite three-fourths of the states and that nevertheless Secretary of State Philander Knox had fraudulently declared ratification.

It was a shocking revelation; it reached deep to the core of our American system of governance.

The Discovery

Article V of the U.S. Constitution defines the ratification process and requires three-fourths of the states to ratify any amendment proposed by Congress. There were forty-eight states in the American Union in 1913, meaning that affirmative action of thirty-six was necessary for ratification. In February 1913, Secretary of State Philander Knox proclaimed that thirty-eight had ratified the Amendment.

In 1984 Bill Benson began a research project, never before performed, to investigate the process of ratification of the 16th Amendment. After traveling to the capitols of the New England states and reviewing the journals of the state legislative bodies, he saw that many states had not ratified. He continued his research at the National Archives in Washington, D.C.; it was here that Bill found his Golden Key.

This damning piece of evidence is a sixteen-page memorandum from the Solicitor of the Department of State, among whose duties is the provision of legal opinions for the Secretary of State. In this memorandum, the Solicitor lists the many errors he found in the ratification process.

These four states are among the thirty-eight from which Philander Knox claimed ratification:

California: The legislature never recorded any vote on any proposal to adopt the amendment proposed by Congress.

Kentucky: The Senate voted on the resolution, but rejected it by a vote of nine in favor and twenty-two opposed.

Minnesota: The State sent nothing to the Secretary of State in Washington.

Oklahoma: The Senate amended the language of the 16th Amendment to have a precisely opposite meaning.4

When his project was finished at the end of 1984, Bill had visited the capitol of every state from 1913 and knew that not a single one had actually and legally ratified the proposal to amend the U.S. Constitution. Thirty-three states engaged in the unauthorized activity of altering the language of an amendment proposed by Congress, a power that the states do not possess.

Since thirty-six states were needed for ratification, the failure of thirteen to ratify was fatal to the Amendment. This occurs within the major (first three) defects tabulated in Defects in Ratification of the 16th Amendment. Even if we were to ignore defects of spelling, capitalization and punctuation, we would still have only two states which successfully ratified.

Bill Benson’s findings, published in “The Law That Never Was,” make a convincing case that the 16th amendment was not legally ratified and that Secretary of State Philander Knox was not merely in error, but committed fraud when he declared it ratified in February 1913. What follows is a summary of some of the major findings for many of the states, showing that their ratifications were not legal and should not have been counted.

The 16th amendment had been sent out in 1909 to the state governors for ratification by the state legislatures after having been passed by Congress. There were 48 states at that time, and three-fourths, or 36, of them were required to give their approval in order for it to be ratified. The process took almost the whole term of the Taft administration, from 1909 to 1913.

Knox had received responses from 42 states when he declared the 16th amendment ratified on February 25, 1913, just a few days before leaving office to make way for the administration of Woodrow Wilson. Knox acknowledged that four of those states (Utah, Conn, R.I. and N.H.) had rejected it, and he counted 38 states as having approved it. We will now examine some of the key evidence Bill Benson found regarding the approval of the amendment in many of those states.

In Kentucky, the legislature acted on the amendment without even having received it from the governor (the governor of each state was to transmit the proposed amendment to the state legislature). The version of the amendment that the Kentucky legislature made up and acted upon omitted the words “on income” from the text, so they weren’t even voting on an income tax! When they straightened that out (with the help of the governor), the Kentucky senate rejected the amendment. Yet Philander Knox counted Kentucky as approving it!

In Oklahoma, the legislature changed the wording of the amendment so that its meaning was virtually the opposite of what was intended by Congress, and this was the version they sent back to Knox. Yet Knox counted Oklahoma as approving it, despite a memo from his chief legal counsel, Reuben Clark, that states were not allowed to change it in any way.

Attorneys who have studied the subject have agreed that Kentucky and Oklahoma should not have been counted as approvals by Philander Knox, and, moreover, if any state could be shown to have violated its own state constitution or laws in its approval process, then that state’s approval would have to be thrown out. That gets us past the “presumptive conclusion” argument, which says that the actions of an executive official cannot be judged by a court, and admits that Knox could be wrong.

If we subtract Kentucky and Oklahoma from the 38 approvals above, the count of valid approvals falls to 36, the exact number needed for ratification. If any more states can be shown to have had invalid approvals, the 16th amendment must be regarded as null and void.

The state constitution of Tennessee prohibited the state legislature from acting on any proposed amendment to the U.S. Constitution sent by Congress until after the next election of state legislators. The intent, of course, is to give the proposed amendment a chance to become an issue in the state legislative elections so that the people can have a voice in determining the outcome. It also provides a cooling off period to reduce the tendency to approve an idea just because it happens to be the moment’s trend. You’ve probably already guessed that the Tennessee legislature did not hold off on voting for the amendment until after the next election, and you’d be right – they didn’t; hence, they acted upon it illegally before they were authorized to do so. They also violated their own state constitution by failing to read the resolution on three different days as prescribed by Article II, Section 18. These state constitutional violations make their approval of the amendment null and void. Their approval is and was invalid, and it brings the number of approving states down to 35, one less than required for ratification.

Texas and Louisiana violated provisions in their state constitutions prohibiting the legislatures from empowering the federal government with any additional taxing authority. Now the number is down to 33.

Twelve other states, besides Tennessee, violated provisions in their constitutions requiring that a bill be read on three different days before voting on it. This is not a trivial requirement. It allows for a cooling off period; it enables members who may be absent one day to be present on another; it allows for a better familiarity with, and understanding of, the measure under consideration, since some members may not always read a bill or resolution before voting on it (believe it or not!). States violating this procedure were: Mississippi, Ohio, Arkansas, Minnesota, New Mexico, West Virginia, Indiana, Nevada, North Carolina, North Dakota, Colorado, and Illinois. Now the number is reduced to 21 states legally ratifying the amendment.

When Secretary Knox transmitted the proposed amendment to the states, official certified and sealed copies were sent. Likewise, when state results were returned to Knox, it was required that the documents, including the resolution that was actually approved, be properly certified, signed, and sealed by the appropriate official(s). This is no more than any ordinary citizen has to do in filing any legal document, so that it’s authenticity is assured; otherwise it is not acceptable and is meaningless. How much more important it is to authenticate a constitutional amendment! Yet a number of states did not do this, returning uncertified, unsigned, and/or unsealed copies, and did not rectify their negligence even after being reminded and warned by Knox. The most egregious offenders were Ohio, California, Arkansas, Mississippi, and Minnesota – which did not send any copy at all, so Knox could not have known what they even voted on! Since four of these states were already disqualified above, California is now subtracted from the list of valid approvals, reducing it to 20.

These last five states, along with Kentucky and Oklahoma, have particularly strong implications with regard to the fraud charge against Knox, in that he cannot be excused for not knowing they shouldn’t have been counted. Why was he in such a hurry? Why did he not demand that they send proper documentation? They never did.

Further review would make the list dwindle down much more, but with the number down to 20, sixteen fewer than required, this is a suitable place to rest, without getting into the matter of several states whose constitutions limited the taxing authority of their legislatures, which could not give to the federal govern authority they did not have.

The results from the six states Knox had not heard from at the time he made his proclamation do not affect the conclusion that the amendment was not legally ratified. Of those six: two (Virginia and Pennsylvania) he never did hear from, because they ignored the proposed amendment; Florida rejected it; two others (Vermont and Massachusetts) had rejected it much earlier by recorded votes, but, strangely, submitted to the Secretary within a few days of his ratification proclamation that they had passed it (without recorded votes); West Virginia had purportedly approved it at the end of January 1913, but its notification had not yet been received (remember that West Virginia had violated its own constitution, as noted above).

Wonder what would happen if millions of people suddenly applied for their refund, including a copy of this memo with their order.

Nuclear war would break out

The book "The Law That Never Was" documents how the 16th amendment was never properly ratified and truly is not law.

Doesn't matter. They. Don't. Care.

Quick search for Becraft and Duncan returns this:

"Larry Becraft, the attorney in the case referenced in the memo who is mistakenly identified in it as "Lowell Bercraft," also told the Daily Herald the document was a forgery, stating that he tried to argue that the 16th Amendment was not valid but lost the case. He also pointed out that the "memo" gave the wrong first name for the U.S. Attorney prosecuting the case, Roger Duncan."

https://www.thelawthatneverwas.com/

In 1984 William J. Benson of South Holland, Illinois, began an investigation of the process of ratification of the 16th Amendment, to determine if the amendment had lawfully been made a part of the constitution. To undertake such a task, never before performed, required the review of all documents stored in various state archives, state law libraries, legislative libraries and offices of the secretaries of states, clerks of the houses and secretaries to the senates, that related to the method by which the States in the American Union in 1913 allegedly approved the amendment as a part of the constitution. Undaunted by the enormity of such a research project, Bill spent virtually the entire year traveling to the state capitols to find dusty old records regarding the actions of the states taken to adopt the amendment. This was an arduous task that Bill had been well trained for during his years as an investigator with the Illinois Department of Revenue.

The Premise

The federal government rests its authority to collect income tax on the 16th Amendment to the U.S. Constitution—the federal income tax amendment—which was allegedly ratified in 1913. In 1895, the U.S. Supreme Court had ruled that a similar federal income tax act adopted in 1894 was unconstitutional. This deprived the federal government of a potential source of tax revenue. In 1909, the 16th Amendment was proposed by Congress to circumvent that decision by the U.S. Supreme Court. By 1913, the process of ratification of the amendment was claimed to have been completed. Because of the existence of this amendment, the federal government lays claim to the power to collect this tax from all of us.

The Discovery

Starting in January 1984, Bill went first to the capitols of the New England states and performed his investigative research, using the journals of the various state legislative bodies to find out how these states acted upon the proposal by Congress to amend the U.S. Constitution to permit a federal income tax law. After review of these records, he began to see that serious problems existed as to whether these states had legally ratified the same amendment which had been proposed by Congress. When examination of the records of about 20 states showed that many had not ratified the amendment and that information regarding the action taken by these States had been sent to the U.S. Secretary of State, he determined that records in Washington, D.C. most probably existed to prove the point.

In August 1984, Bill traveled to Washington, D.C. to research the historical records in the National Archives. After several days of pursuing fruitless leads, he finally found a book that had contained within it all federal records which had been prepared during the process of amending the Constitution by the 16th Amendment. This proved to be an exceptional discovery because those documents revealed that a man named Philander Chase Knox, the Secretary of State in 1913, was fully aware that the amendment had not been ratified nonetheless. See Bill Benson's Golden Key. After making this important discovery, Bill decideded it was essential that he also study the records of all other states which the federal government claimed had ratified the amendment.

In September 1984, Bill started investigating the remainder of the states and completed the project on December 1984. When this year long project was finished at the end of 1984, Bill knew that not a single state had actually and legally ratified the proposal to amend the Constitution in the manner required by law. Such a conclusion obviously meant that the federal government lacked the power to legally impose and collect the federal income tax. See defects tabulated in Defects in Ratification of the 16th Amendment.

To demonstrate the merits of this argument, an examination of the evidence uncovered by Bill is essential. The federal government claims that the State of Kentucky was the second state to ratify the amendment, such action taking place on February 8, 1910. But, the records of the State of Kentucky reveal a far different picture. These records show that the Kentucky House proposed a resolution to adopt the amendment and then sent that resolution to the Senate in early February 1910. On February 8, 1910, the Kentucky Senate voted upon that resolution, but rejected it by a vote of 9 in favor and 22 opposed. The Kentucky Senate never did ratify that amendment, but federal officials, being in possession of documents showing this rejection, fraudulently claimed otherwise.

A second interesting situation involves the State of Oklahoma. Here, this proposed amendment was passed by the Oklahoma House and the language of the resolution perfectly matched the one passed by Congress. However, the Oklahoma Senate obviously disliked what Congress had proposed, so it amended the language of the 16th Amendment in such a fashion as to have a precisely opposite meaning. After all was settled and done in Oklahoma, the Oklahoma Legislature wanted an amendment which meant something entirely different than that which was proposed by Congress.

What happened in California reveals a comedy of errors. That legislative assembly never recorded any vote upon any proposal to adopt the amendment proposed by Congress. However, assuming that a nonexistent vote was taken, whatever California did adopt bore no resemblance to what Congress had proposed. And many states engaged in the unauthorized activity of amending the language of the amendment proposed by congress, a power that these states did not possess.

The State of Minnesota sent nothing to the Secretary of State in Washington, but this did not deter Philander Knox as he claimed that Minnesota ratified the amendment regardless of the absence of any documentation from the State of Minnesota.

The Fraud

Article V of the U.S. Constitution controls the amending process, which requires that three-fourths of the States ratify any amendment proposed by Congress. In 1913, there were 48 States in the American Union, so to adopt any amendment required the affirmative act of 36 states. In February 1913, Knox issued a proclamation claiming that 38 states had ratified the amendment, including Kentucky, California and Oklahoma. But, as previously shown, Kentucky had rejected the amendment, California had not voted on it and Oklahoma wanted something entirely different. If just these 3 states are excluded from the court of those which ratified, then the amendment was not legally adopted, the number of ratifying States being only 35. But, then again, a total of 11 states failed to vote on the amendment, 33 changed the language of the amendment and Minnesota sent in nothing. If the process of the adoption of the amendment is subjected to strict legal scrutiny the amendment was adopted by none.

Today, the federal government pretends that it has all encompassing power to tax the income of everyone and that the only way to change this system is to vote for congressmen who promise to modify or, even more unlikely, to repeal these laws. The American public needs to be apprised that another alternative exists and that it is entirely possible to challenge the very foundation of this taxing power upon the grounds that the 16th Amendment to the U.S. Constitution was never adopted. This challenge can be effectively made by exercising your rights under the First Amendment to the United States Constitution.

I always knew they never ratified this.

Stickied for deeper Research Anons. We need more validity, per State. Let’s get digging!

This is absolutely true, I know a guy who went up against the IRS with this exact argument and to this day he has never paid income tax, he finds jobs that 1099 him and then he throws them away he is an over the road truck driver.

Hey Grok, was the us 16th amendment officially ratified?

Grokaganda.

The amendment that was ratified was not in the exact same wording as the one Congress actually agreed on. It has to be exact. Or else it's...

Illegitimate.

I do not disagree with you that Grok needs to be whipped into shape on occasion. I did ask a follow-up question and got the following result for what it is worth.

I then asked this, "What was the original income tax amount and who had to pay the first income taxes?"

[This is 100% how the government works. We are going after the Big Bad Rich! We'll only tax the wealthy! And all the people say, yeah, and support it. The smart wealthy people use business entities and invest their profits each year to minimize their tax burden and then when the taxes need to include more and more people to make sure the government is funded. The dumbshits that bought into the lie end up paying the taxes and then complain and fall for the next boondoggle. Repeat, repeat, repeat.]

At the time, most Americans earned far less than the exemption thresholds—average annual wages were around $800—so the tax was designed to affect only the affluent. Filing was simple: taxpayers submitted a Form 1040 (yes, it existed back then), and the system relied heavily on self-reporting with minimal enforcement mechanisms initially.

This structure evolved over time, especially with World War I, when rates increased and exemptions dropped to fund the war effort, broadening the tax base significantly. But in 1913, it was a narrow, elite-focused tax.

When it seems to good to be true, it likely isn't true.

I’ve seen this before. Can OP show the where this came from that is an official .gov site? Was it done by DOGE, I doubt it. When the letter says absolutely everything you wish was true. It’s suspect.

its a bombshell though, so...

This keeps popping up. No one has been able to confirm this letter.

Wait until you hear about the fed

IRS and the FED go hand and hand..The IRS is the FEDS hand in our pocket

FAKE AND GAY ALERT!!!

All Karen’s must unite. This is their time! Then we will be behind them demanding our money back NOW!

So what forms do I file to get back 40 years of personal txes, business taxes and the taxes I have to pay on my payroll?

I wouldn’t do that if I were you. This is a nothing burger.

I am afraid that calls for the 2nd amendment...

The 223, 30.06 & 7.62