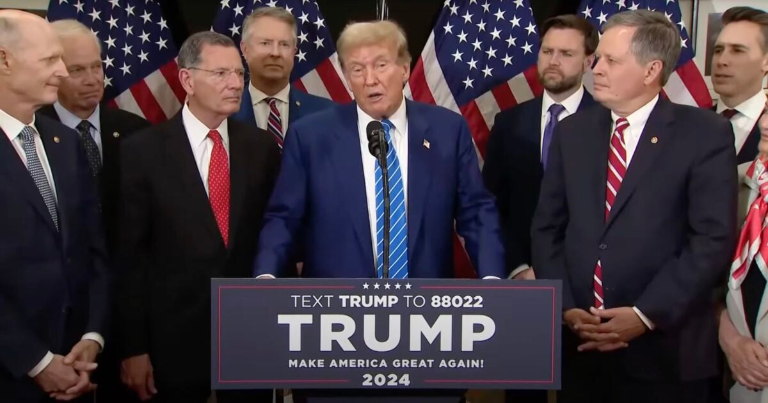

💥🦁💰 Trump Drops Bombshell Proposal: Allegedly Suggests Eliminating Income Tax in Favor of High Import Tariffs During DC Republicans Meeting 💥🦁💰

(www.thegatewaypundit.com)

🏁 - A WINNING MOVE - 🏆

Wow! Getting back to the Constitution. How novel!

Not only would Americans get to keep way more take-home pay, but foreign goods, like those from CHINA, would get too expensive to buy, which would mean more AMERICAN MANUFACTURING and more jobs in AMERICA.

The only people pissing and moaning about it on the right will be Globalist RINOs. The people on the left are too stupid to understand any of it.

The left will keep voting commie as long as they are promised more free sh!t tomorrow.

And as we all know, tomorrow never comes.

Import tariffs would not become so dramatically expensive that people couldn't afford it, especially paired alongside an income tax elimination.

Remember, it's not about making the consumer pay more; it's about making it more attractive for manufacturing to return to the states.

Also -- and this is critical -- create a system that is predictable and transparent to the end consumer. If I am importing a product from overseas, let me see what that tariff cost would be before purchase so that it doesn't end up in the hands of U.S. customs with no recourse because they charged a sum that was higher than expected.

Not to be a Debby Downer but... this idea that “manufacturing would return to the US” is a flawed one. Especially if you think the cost of the item being made here would be cheaper because of it having “no tariff.”

Let’s take Hot Wheels (the toy cars) for example. The price point for a regular Hot Wheel car has hovered at $1 for almost 30 years. If you suddenly tariff this item: 1. The price would greatly be effected 2. If you expect that same item to suddenly be manufactured in America you have to wait for the manufacturing plant to be built at a tremendous cost. 3. That new plant and the cost of the raw materials and labor cost gets baked into each and every one of those toy cars that will no longer be sold for $.99. The true cost to the consumer would be closer to the “tariffed” version of the car whatever that would be.

To think, “it’ll be wonderful,” manufacturing will just magically come back to the US is a foolish one. The reason manufacturing left the US in the first place is because of our demand for cheaper goods. Our labor costs/rents/leases/machinery skyrocketed forcing companies to find cheaper manufacturing elsewhere.

This isn’t the solution you think it’s going to be. Even if you took away the tariffs so the US could compete on an international level the US isn’t going to start making Hot Wheels in Arizona for example because it would be insanely cost prohibitive to do so. This goes for every other item you can think of that would be made here. The reason a basic Hot Wheels car is so cheap is because slave labor usually is much cheaper. Coupled by the fact that the machinery used in manufacturing the toy cars was paid off decades ago. Plus, the raw material is dirt cheap in places like China... again helped by “slave labor” costs.

Bring everything you need to manufacture a basic Hot Wheel car to the US and that toy car would cost at minimum $5 to purchase. Fun fact the basic Hot Wheel car has never been mass produced in the US for a reason... production costs.

So, as great as tariffs sound to you and me, it doesn’t necessarily translate to “all goods” making sense to being manufactured in the US without a tripling of costs passed onto the consumer.

Another fun fact, most of our goods made in other countries are typically subsidized heavily by those governments. Baskin Robbins (31 Flavors) ice cream sold to the consumer in the US is actually manufactured in Canada. Because it’s cheaper to import ice cream into the US due to subsidies from the Canadian government. US labor and manufacturing couldn’t keep Baskin Robbins competitive in the US market anymore so they relocated production to Canada. The tariff catch-22 here would force Baskin Robbins into bankruptcy. Good bye to all the ice cream shops around the country if all of a sudden you force Baskin Robbins to choose, continue importing at a tariffed cost or build a manufacturing plant in the US and pass that “new” production cost onto the consumer. The real loser here would be the consumer.

The scary prospect of tariffs is how many goods will suddenly vanish from store shelves never to be replaced - or - they will exist just tremendously more expensive, especially if it’s stamped “Made in the USA.”

Tariffs are truly an inflationary tax on the consumer in so many ways.

By dumping tariffs on companies, they have to choose if access to the massive American market is worth the increased burden.

It resolves the problems on many levels and while it introduces a few new ones, those new ones can be resolved with intelligent incentives and time. What can't be solved are the problems with manufacturing leaving the country in droves for decades.

If -- and when -- they try to pass the cost on to consumers, consumers should be smart enough to say "nah, I don't think I'm going to buy that", and over time -- again, time -- they will have to make the decision to pull out entirely or acquiesce to building manufacturing facilities and employing Americans.

All of these companies have vast coffers of cash that they didn't have before, and now it suddenly costs way more to build manufacturing for those "$1 Hot Wheels" cars? That's cute.

The United States does not have to respect the patents for products that are not produced or marketed here and nor should we. If it means some other company rises up using similar technologies, then that is a good thing.

It is a multifaceted problem that requires many solutions, but literally -- LITERALLY -- everything that is being done now is wrong, so we need to stop moving this direction and turn back.

There is no need to complain about rising costs (from tariffs) if you keep your money instead of losing a massive chunk every pay period.

I tried explaining this to my sister and she doesn't buy it. I had to stop myself without giving a dissertation of the history of our money and why the income tax was created.

Love her to death, but sometimes her lack of knowledge or willingly not wanting to learn kills me.

This is everyone in my immediate family. Willfully ignorant.

I believe this is exactly why it will never happen. Americans with steady employment and disposable income are Americans that are difficult to rule over. Income tax is how to keep incomes low and the population controlled, a lever of power this critical to the ruling class will never disappear absent a miracle or abolishment of our government.

I'd like to see property tax go away as well as income tax. And make state income tax illegal while you're at it.

Property tax is the most immoral of all taxes as it is a tax on one's very existence, since as physical beings we all must reside somewhere. The other taxes you can mostly avoid by not undertaking the activity they are taxing.

Yep. We are basically serfs who cash rent our land from the lord

Local income tax has to be the most egregious. Like, how in the fuck do they think they have that authority? Actual clowns.

Local makes more sense than federal, anyway.

Still makes no sense, though.

Property tax going away would be the best of all. Maybe start slow and make it so you don't get taxed in a flexible capacity years after you buy your home.

Start it at precisely the rate you paid upon purchase. Then go down...not up.

Nothing pisses me off more than when the county comes in and assesses your property valuation at 3x what you paid for it because someone paid that much for a house in your neighborhood. I bought in an affluent area in North Texas back in 2013…2000sq ft, 1/2 acre tree lot with a pool…paid 208k for that house, now my property taxes are valued at 600k. We bought because it made sense and didn’t want to be house poor, now 11 years later the house payment is almost 500.00 more a month, just on property taxes. It’s beyond insane.

It sucks because it's also rigged. When does valuation ever go down? It doesn't. It only ever goes up.

Even if it's a semi-permanent change, having your payments go down over time depending on how long you've owned the property makes a ton of sense on many different levels, and it incentivizes owners to stay at and improve their homes rather than leaving, which makes the neighborhood look better.

Also eliminate sales tax from necessities.

I agree. With the result being that the extra $$ in people's pockets after eliminating taxes, they will have more to spend on non-necessities.

Property tax is a luxury tax. Property tax should be based on how your home or property impacts the community. If you have 10 bathrooms you’re going to use more water and send more down the sewer. If we each have the same bathrooms, same amount of square footage and the same size driveway but your house was built in 1920 and mine was built last year with newer amenities my tax shouldn’t be higher just because mine is twice the market value as yours.

I'm not sure how you value this, but I'm not on city water - I am self-contained with a well. Also, I produce an agricultural product (fruits and berries) that provide a resource to the community. So I think your formula is flawed. Once I pay off my property, I should not have to pay tax to the borough or state to use it.

Can we also stop giving money to every country on Earth? Can we stop being an empire? Can we begin to cherish and take care of what we are and what we have? Can we value education and developing yourself into the very best you can be? Can we value fitness again, like JFK promoted? Can we be the very best version of America?

property tax is the most onerous.

I am convinced one of the reasons Dominion thinks their voting system is worth billions, i.e. their billion dollar lawsuits against companies and people, is because Dominion controls the votes on property tax referendums that fund schools.

If election fraud is real, it is, then how do we know that referendums actually pass when they may have been voted down?

Schools request hundreds of millions all the time. Multiply each school referendum nationwide and you have many billions in value that Dominion controls.

Follow the money.

And estate taxes

That's kind of what the Fairtax would do. 23% tax on sales but if you remove all taxes built into US goods prices stay the same but the cost of goods made overseas would still have the same production costs but now a 23% tax on their sale.

Current budget shows that 94% of revenue comes from income taxes; 6% comes from everything else.

Need to cut the budget 90% -- which SHOULD happen, but WILL it?

Hate to say it, but Reagan and Trump were the big deficit spenders.

History of federal bugets -- revenues and expenses -- going back to 1930:

https://www.presidency.ucsb.edu/statistics/data/federal-budget-receipts-and-outlays

This is the way!

This is exactly what we need. If there really is a foreign good we need then pay for it! Even if at starters it costs double, everything else will be cheaper & it will incentivize someone here to make it here! This is only good.

Get to cut the whole IRS & their gestapo. Huge savings there plus less interrogation & harassment of patriots!

This was the norm before 1913.

If he can make it happen....I mean damn.

Sou ds reasonable to me.

Taxes need to go away when the government can weaponize them. The IRS needs to go too.

We really have known for years that income tax would be gone.

I can tell you I would be happy crying while doing the happy dance if he got rid of income taxes. He probably couldn't do it, because I would assume it's up to each state, but getting rid of state taxes also would be amazing, and property tax.

Just found out our home insurance went up again over $900, it just went up about 4 months ago and now again.

Almost as if someone wants to make home ownership impossible for the middle class.

Some states like Florida do not have income taxes right now.

Yes, but Alabama does, they tax everything here.

This will happen.

But we still will have sales tax, property tax, fuel tax, road tax, yada yada yada.....we'll probably see an increase of take home pay of a thousand bucks a year. Let's get rid of ALL taxes! If counties need money to fund roads and schools, then how about coming up with something else. There is an answer that would not cost too much, but folks won't like it. Heck, they'd scream they want the money to be taken away from them to have smooth roads and educated kids.

Eliminate all taxes except sales tax on new products only. Most of taxes collected do not go to serve the people, 90% go to Rothschilds Bank of International Settlements in the City of London

Looking forward to my $20k raise. Just get rid of SS, too.

Can't wait to see Cali and other blue shit holes raise their taxes by the same amount since their citizens now have "extra" like Virginia did with the gas tax, lmao.

So many young people more than ever are becoming aware of how much they pay in taxes. Having Trump talking like this will be yet another huge draw for support.

I'd rather see the confiscation of property and money from those involved in crimes against humanity, global banking cabal, drug kingpins, etc. coupled with an immediate 50% reduction in the size of government. Then a full on press to return all manufacturing to the U.S. and tax domestic companies that go outside the U.S. to make their goods for domestic consumption. We then need to re-imagine education and get rid of antiquated teaching methods and put more emphasis on job skill creation by working with companies to have people ready to enter the work force upon high school graduation. The undergraduate college degrees are mostly worthless in their present form. Rather, technical and trade schools should be where most students go to earn high paying job credentials of value. With this in place we could eliminate income tax in favor of a low rate luxury sales tax.

I can only get soo hard! Please Mr President... make it soo!

So like it used to be before the wars and government shakedowns.

Rewind to pre-1913... eliminating it would fix our economy for so many reasons.

I don't know how the welfare/freeloader money laundering scheme would be fixed, but I'm guessing Project 2025 has already started working that out

https://archive.is/z76oG

Fuckin'

A!!!!!

This is great for all young people and for freedom, but it's an absolutely shit deal for older Americans who already paid a lifetime of income taxes only to see their savings and retirement benefits get gobbled up by tariffs which raise the price of goods, whether you're buying imports of domestic production that can now raise its prices higher.

But if you are off grid you are self sufficient, no?

For convenience sake currently I am not. For water, sewer, and power I mostly am.

But, I use about 250 gallons of propane a year for cooking and hot water (most usage is in the warm weather months when the wood boiler isn't running, but also anytime the thermal storage tank drops under about 130 degrees some temperature boosting happens from the instant water heater).

By the third cloudy day in a row I may have to burn a gallon or two in the generator depending what is going on and what I can postpone.

And I buy all my food, except sweet corn. I earn enough in three weeks of work to feed me for the whole year, and could actually live on half that if I had to (swap out ribeye or sirloin for pork, chicken, or hamburger). Anybody subsistence farming 100% of their food intake is spending more than that amount of time gardening and feeding, watering, and cleaning up after animals. I do have a number of years of food stored (a crazy friend stocked up for Y2k for his family of 4 and needed to unload it to fight his drug addicted wife for custody of his kids, so he sold it to me for half off and I add to it a bit each year and eat some of it so it strays rotated and never gets too old).

And I currently do my firewood the lazy way too. There is a timber industry up where I live so rather than stomping around in the woods trying to avoid getting killed felling trees I just purchase a truckload of hardwood logs from one of the timber companies (they don't care if they deliver to the sawmill's wood lot or the end of my driveway). Then I use the tractor to load them onto the deck of the wood processor which feeds, splits, and the conveyor fills up a modified IBC tote which the tractor moves into the wood shed for seasoning. I have the saws and mauls and COULD do it all manually from my acreage, but it's so much easier to do it the way I do it.

The cool thing is Democrats are going to come out now and have to argue against this.

The idea of an income tax is something the Founders found reprehensible and immoral.

The 16th Amendment was never LEGALLY ratified (look it up, statists). The unthinkably abusive confiscation-and-intimidation scheme is completely unconstitutional, like most of the fedgov.

Done right, you can get the other countries to eat most of the tariff.

For low income earner what they pay in federal income tax is returned to them in full but they have to wait.

This new proposal by President Trump would have the money available for those people immediately instead of the holding the money for months with no way of it growing or making use of it.

Federal income taxes being eliminated for high income earners would help them provide relief as many are also hit with high taxes at State and city levels. Property taxes tend to be higher for those income brackets too.

That freed up money would increase service sector activity.

Not an accident that he's floating the idea of ending the income tax at the same time he's starting to embrace bitcoin openly

And maybe the same time the fed comes to an end?

Bitcoin ends both the fed and taxes in one stroke

Amen. If we could abolish income tax, estate tax and property tax (all evil theft) thos country would soar financially I think

Can't, the math doesn't work. In 2024 Federal spending is $6.5 TRILLION. In 2022 TOTAL US imports totaled $3.2 trillion.

How much money do you think a 200% tariff will raise? Nowhere near enough because a $10 item from China becomes a $30 item after you add the tariffs, so people will buy the $25 American produced version and avoid the tariff. Plus if you slap that kind of tariff on other nations they'll retaliate and crush your exports.

Oh, and about 27% of those imports are from Canada and Mexico, so you're going to have to scrap NAFTA to impose those tariffs.

https://www.cbo.gov/publication/59946 https://ustr.gov/countries-regions

$6.5 trillion is not the correct number. Most of the Federal budget was borrowed. So nothing changes there. You still either need to learn to live within your means or you don't.

Total income taxes paid by individuals was only $2.2 trillion, substantially less.

Of actual taxes (that would be affected by eliminating the income tax) 40% goes to pay interest on the debt, so simply allowing this to default recovers a lot. And you can bet the budgets for a lot of the Federal programs are going to be heavily slashed. The entire Dept. of Education for one is going to be eliminated.

It is possible. You have to consider what is going to be thrown out though.

Absolutely - entire Federal departments can either be eliminated (Dept of Ed is a great example) or have their budgets cut by a substantial amount. Government(s) are incredible wasteful. And as far as foreign items costing more it will motivate American companies to produce the same product(s) here.

Spending didn't fall under Trump the first time, so I don't know why I'd expect it to be different this time around. The Senate isn't going to pass any budget that kills the Department of Education unless some radically different kind of Republicans get elected in number we haven't seen before.

It would be interesting to see how much of the 6.5 trillion budget is spent on Americans. For example, I recall the covid relief bill sent 93% of the money overseas to be laundered.

My number may not be exact but it was a huge percentage like that.

There is massive spending on pork projects, i.e. payback payments for being "selected" in "elections."

With such a huge budget, why aren't our roads, bridges, and airports pristine? 🤔